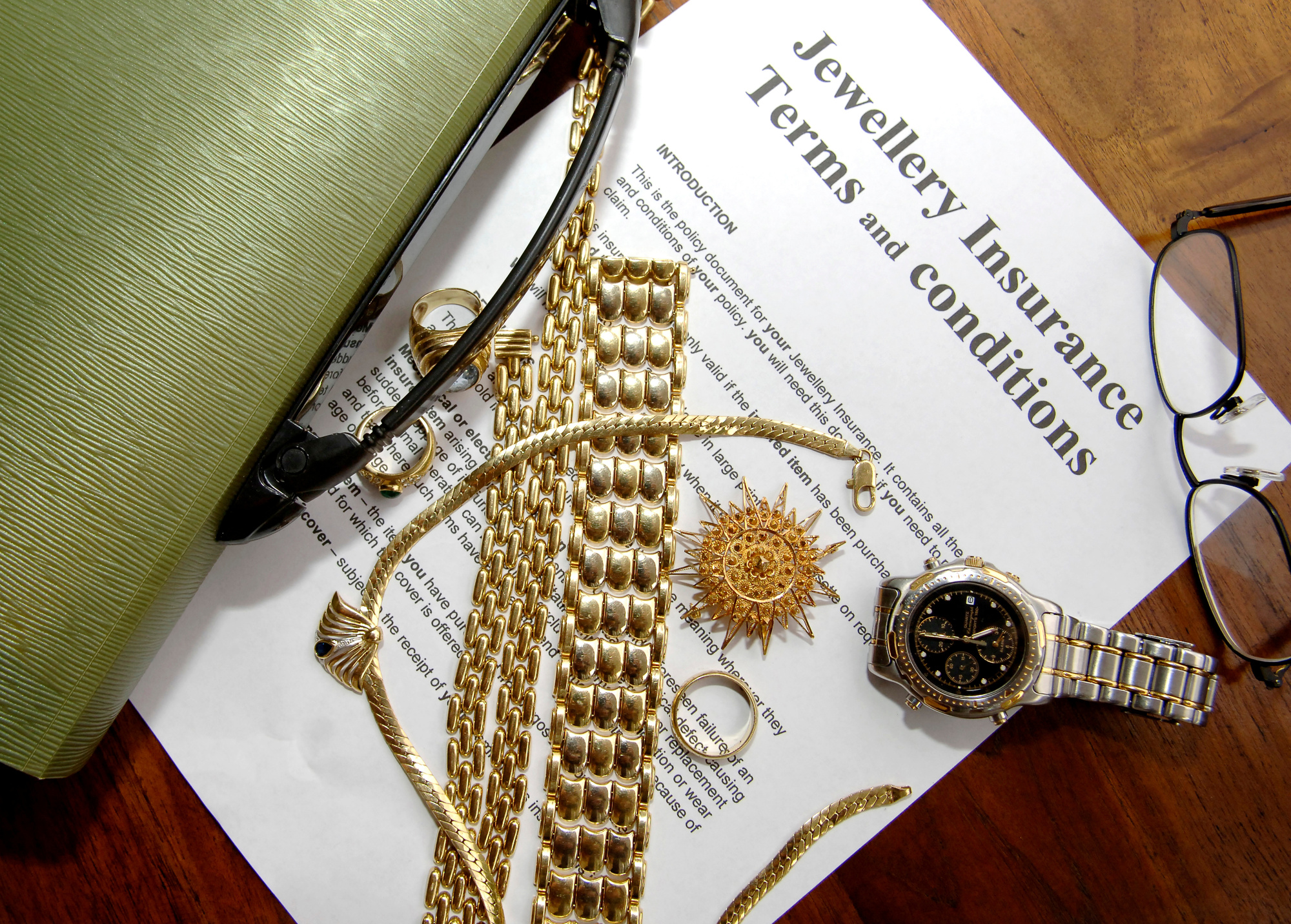

How To Insure Jewellery: A Guide For Newlyweds

When you’re newly married, the excitement of wearing your wedding rings and engagement ring can sometimes overshadow the thought of protecting them.

Yet, insuring your jewellery is one of the best ways to secure your valuables against loss, damage, or theft. For items as precious as wedding and engagement rings, having a jewellery insurance policy gives you peace of mind and a lot more.

This guide will help you understand the best options and what to look for in a jewellery insurance policy to keep those precious pieces safe. Read on to learn more.

Why Newlyweds Need Jewellery Insurance

Your wedding and engagement rings represent more than just beautiful pieces—they’re symbols of love and commitment. Given the significant investment and sentimental value of these items, opting for jewellery insurance is a wise decision. Regular homeowners or renters’ insurance policies often don’t provide adequate protection for high-value jewellery, especially when it comes to accidental loss or mysterious disappearance. The best jewellery insurance options offer specialized policies designed to cover valuable jewellery with specific benefits that standard policies lack.

Types of Jewellery Insurance Policies

When exploring jewellery insurance options, you’ll find several different types that vary in coverage, cost, and terms. Here are a few key policy types that can provide peace of mind:

1. Specialised Jewellery Insurance

If you’re looking for a plan that explicitly protects wedding and engagement rings, consider specialized jewellery insurance. Policies from insurers like Ringo Jewellery Insurance often allow customisation, providing options to cover various jewellery pieces individually, with benefits tailored for fine jewellery and gemstone items. Specialised jewellery insurance policies may also come with features such as insurance value adjustment to reflect the current worth of your jewellery, giving you confidence that your items are fully protected.

2. Standalone Jewellery Insurance Policies

Many newlyweds find a separate jewellery insurance policy, like a standalone policy, to be the best way to protect valuable pieces. You can find reputable companies that offer specialised coverage, including worldwide travel, accidental loss, and theft protection, going beyond the limited terms of most homeowners’ policies. With a standalone jewellery insurance policy, coverage is usually more comprehensive and flexible, giving you higher coverage limits and options for worldwide protection.

3. Homeowners or Renters Insurance Riders

Some homeowner’s or renters’ insurance policies allow you to add a rider for valuable items, including fine jewellery, through what’s called personal property coverage. However, these policies typically come with low coverage limits, meaning they may not cover the total value of an engagement ring or other valuable jewellery pieces. Additionally, standard policies often exclude protection from accidental loss or mysterious disappearance, which can be a concern for new jewellery owners.

Choosing the correct type of jewellery insurance policy can give newlyweds confidence that their valuable pieces are well-protected, especially in high-risk circumstances.

Factors to Consider When Choosing Jewellery Insurance

Finding the right policy means balancing coverage, cost, and convenience. Here are some essential factors to consider as you look for the best jewellery insurance:

1. Cost of Jewellery Insurance

The cost of a jewellery insurance policy often depends on the jewellery’s appraised value and coverage type. It’s wise to get a jewellery appraisal from a preferred jeweller to determine the replacement cost. Be sure to ask about the deductible, as jewellery insurance deductibles can vary significantly. While some policies have no deductible, others may have one based on the item’s value.

2. Coverage Limits and Deductibles

Look into the coverage limits for each policy, as well as any deductible you may be required to pay in the event of a claim. For example, some insurers set coverage limits on high-value items like engagement rings, while others offer flexible policies with adjustable limits. A higher deductible might reduce your monthly premium, but it could also mean a higher out-of-pocket cost in case of loss or theft.

3. Accidental Loss and Mysterious Disappearance

Not all jewellery insurance policies cover accidental loss or mysterious disappearance. If you want peace of mind, opt for a policy that includes unintentional loss, particularly for items worn daily, like wedding rings and engagement rings. Some providers offer simplified jewellery insurance claim processes in these situations.

4. Appraisals and Insurance Value Adjustment

A gemstone grading report or jewellery appraisal can help establish an item’s replacement cost, allowing you to choose the right amount of coverage. Some insurance companies provide automatic insurance value adjustments, ensuring your policy reflects the jewellery’s current value without requiring frequent reappraisals.

By carefully evaluating coverage options, costs, and protection levels, newlyweds can find a jewellery insurance policy that perfectly fits their needs, ensuring peace of mind for years to come.

Jewellery insurance is a wise, protective step for any newlywed couple looking to secure their valuables against theft, loss, or damage. Checking out various jewellery insurance options helps you discover the best coverage for your valuable pieces. It’s a minor expense that can significantly safeguard the meaningful tokens of your relationship.